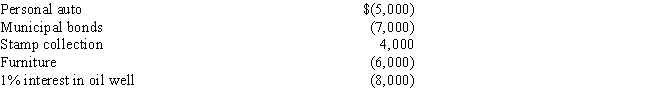

Willie sells the following assets and realizes the following gains (losses) during the current year:

As a result of these sales,Willie's adjusted gross income will:

Definitions:

Organizational Restructuring

The act of realigning or changing the organizational structure, processes, or cultures of a company to improve efficiency, effectiveness, or adapt to new strategies.

Downsizing

The planned reduction of a company's workforce to improve efficiency or reduce costs.

Strategic Human Resource Planning

The process of aligning an organization's human resource capacity with its strategic objectives to ensure it can meet future challenges and opportunities.

Workforce Downsizing

The reduction of an organization's employees to improve its efficiency and reduce costs, often resulting in layoffs.

Q6: Michelle's employer pays for her graduate school

Q13: Tom,Dick,and Harry operate Quality Stores.Based on advice

Q19: Ordinary Expense<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q77: Ralph buys a new truck (5-year MACRS

Q88: George's wife sells stock she purchased 10

Q94: Which of the following taxes paid by

Q100: Margaret is single and is a self-employed

Q101: Kenzie and Ross equally own rental real

Q102: Aunt Bea sold some stock she purchased

Q128: Andy lives in New York and rents