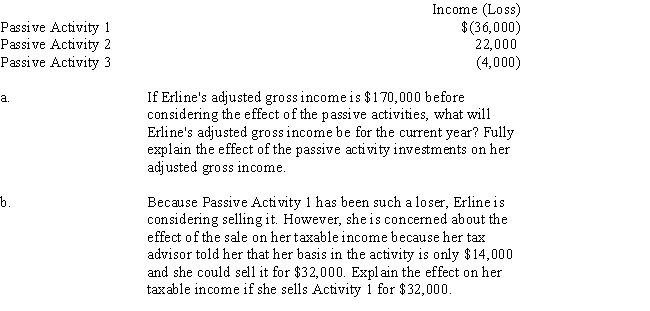

Erline begins investing in various activities during the current year.Unfortunately,her tax advisor fails to warn her about the passive loss rules.The results of the three passive activities she purchased for the current year are:

Definitions:

Cognitive Psychologist

A professional who studies mental processes such as perception, memory, thinking, problem-solving, and decision-making.

Reflexively

Done automatically without conscious thought as a spontaneous reaction or response.

Open Their Mouths

A phrase indicating the act of someone beginning to speak or articulate thoughts, often used metaphorically.

Cheek

The fleshy part of the face below the eye and between the nose and the ear, important for expression and speech.

Q6: Adjusted basis<br>A)Begins on the day after acquisition

Q8: Which of the following expenses is/are deductible?<br>I.Transportation

Q11: NOL carryforward<br>A)A loss that is generally not

Q24: Barbara was the legal owner of a

Q49: Ronald is exploring whether to open a

Q51: Entertainment,auto,travel,and gift expenses are subject to strict

Q56: Investment interest<br>A)Prepaid interest.<br>B)An amount that each taxpayer

Q79: During 2016,Witt Processing Corporation places $210,000 of

Q83: Mixed-use property<br>A)Land and structures permanently attached to

Q140: Peter,proprietor of Peter's Easy Loan Company,loaned Jessie