During 2016,Marsha,an employee of G&H CPA firm,drove her car 24,000 miles.The detail of the mileage is as follows:

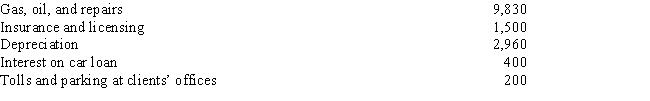

Marsha's 2016 records show that her car expenses totaled $14,320.The details of the expenses are as follows:

What is the amount of her deduction for her use of the car?

Definitions:

Charge Slip

A document or form used to record the services rendered and the charges incurred for a patient in a medical or dental practice.

Debit Balance

Occurs when the amount paid is less than the total due.

Credit Balance

The amount of money in a financial account that is available for withdrawal or use, exceeding what is owed.

Business Associate Agreement (BAA)

A contract between a healthcare provider and a business associate that handles protected health information (PHI) to ensure the associate will protect the PHI in compliance with HIPAA regulations.

Q7: Linda owns three passive activities that had

Q17: Which of the following events is a

Q53: In July of this year,Sam performs financial

Q60: Straight line<br>A)The depreciation method for real estate.<br>B)A

Q93: Jerry's wife dies in September.His wife had

Q104: Rodrigo works as a salesperson for a

Q127: Deductions for AGI<br>A)Prepaid interest.<br>B)An amount that each

Q128: Jennifer's business storage shed is damaged by

Q135: Velma is 16.Her income consists of municipal

Q150: In each of the following independent cases