During 2016,Marsha,an employee of G&H CPA firm,drove her car 24,000 miles.The detail of the mileage is as follows:

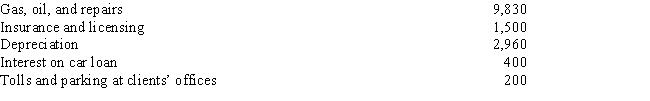

Marsha's 2016 records show that her car expenses totaled $14,320.The details of the expenses are as follows:

What is the amount of her deduction for her use of the car?

Definitions:

Shared Mental Models

Knowledge structures held by members of a team that enable them to form accurate explanations and expectations for the task, and, in turn, coordinate their actions and strategies.

Cross-functional Teams

Groups made up of individuals from diverse specialties or sectors, collaborating to achieve a shared objective.

Cross-functional Teams

Groups that include members with different functional expertise working toward a common goal, often from across departments within an organization.

Task Expertise

A high level of knowledge, skill, or competency in performing specific tasks or functions.

Q16: Lynn is a sales representative for Textbook

Q37: Which of the following taxpayers can claim

Q48: In October of the current year,Brandy and

Q59: All of the following are capital assets,except<br>A)Personal

Q78: Carlyle purchases a new personal residence for

Q91: Travel and lodging expense of $800 incurred

Q116: Susan is 17 and is claimed as

Q133: The information that follows applies to the

Q145: Which of the following best describes the

Q162: Which of the following people is currently