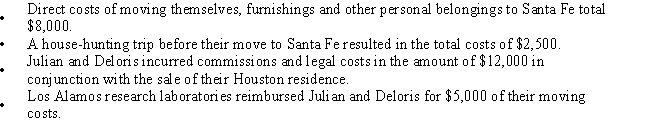

Julian and Deloris move during the current year from their home in Houston to Santa Fe.Julian was a rocket scientist with NASA in Houston and has accepted a new job with the Los Alamos research lab near Santa Fe.Moving expenses and reimbursement information are presented below.

What is their Moving Expense deduction?

Definitions:

Traveler's Checks

Preprinted, fixed-amount checks designed to allow the person signing it to make an unconditional payment to someone else as a result of having paid the issuer for that privilege.

Deposit Slip

A slip accompanying a bank deposit and containing an itemized list of checks or cash deposited, the date, and the depositor’s signature.

Cash

Money in the form of bills or coins, used as a medium of exchange for goods and services.

Write "VOID"

An action taken to invalidate a document or cheque by writing the word "VOID" across it.

Q2: Lydia purchased a sapphire bracelet for $3,000

Q9: Items that are excluded from gross income

Q17: Sergio owns Sergio's Auto Restoration as a

Q20: Nancy teaches school in a Chinese university.She

Q44: Mary inherits an interest in Laser Partnership

Q60: Which of the following is an example

Q100: Bonnie's sister,Diane,wants to open a restaurant.Because Diane

Q111: Active Trader<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q114: Mark has an adjusted gross income of

Q146: Clarance rented office space to an attorney