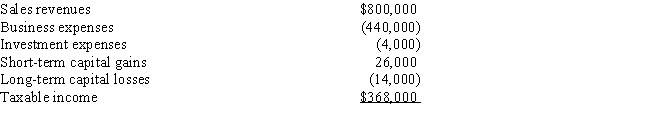

Tom,Dick,and Harry operate Quality Stores.Based on advice from Tom's sister,a CPA,the three form a partnership.Tom owns 50%;Dick and Harry each own 25%.For the year,Quality Stores reports the following:

By how much will Tom's adjusted gross income increase because of the above?

Definitions:

Q41: Tom and RoseMary own a cabin near

Q49: No-additional-cost services and employee discounts must be

Q59: 50% of the self-employment tax is deductible

Q60: Child & dependent care<br>A)An employee may exclude

Q89: For each of the following situations,determine whether

Q90: Sylvia owns 1,000 shares of Sidney Sails,Inc.

Q112: Isabel,age 51 and single,is an electrical engineer

Q113: Teresa won $9,000 playing the Illinois lottery.Which

Q118: Jenny,an individual cash basis taxpayer,has $6,000 of

Q153: Julia spends her summers away from college