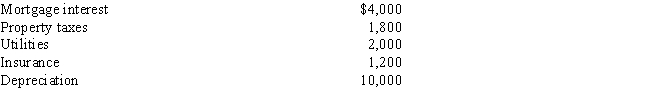

Cornelius owns a condominium in Orlando.During the year,Cornelius uses the condo a total of 25 days.The condo is also rented to vacationers for a total of 75 days and generates rental income of $9,000.Cornelius incurs the following expenses:

Determine Cornelius's deduction related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Innocent Misrepresentation

A false statement made without knowledge of its falsehood, but without intention to deceive, often leading to an altered contract or agreement.

Unilateral Mistake

A contract law concept where one party is mistaken about a basic assumption on which a contract is based, but the other party is not.

Fraudulent Misrepresentation

A false statement made knowingly or recklessly with the intent to deceive, resulting in harm to the victim.

Franchise Agreement

A legal contract in which a franchisor grants the right to operate a business using its brand, system, and support to a franchisee in return for fees.

Q16: Lynn is a sales representative for Textbook

Q18: During the current year,Diane disposes of Fine

Q54: In 2017,a husband and wife who are

Q65: Stephanie and Matt are married with 2

Q77: Judy and Larry are married and their

Q87: In the current year,Paul acquires a car

Q91: Which of the following statements concerning prizes

Q123: Julie travels to Mobile to meet with

Q141: For each of the following situations,determine whether

Q143: Garcia is a self-employed chiropractor and a