Wilson owns a condominium in Gatlinburg,Tennessee.During the current year,she incurs the following expenses before allocation related to the property:

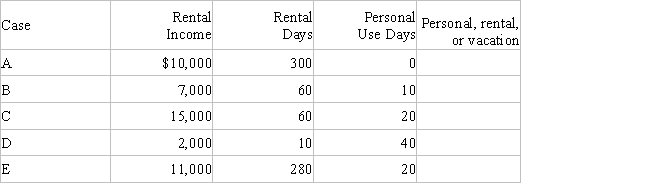

a.For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property,a rental or a vacation home.

b.Consider Case C.Determine Wilson's deductions related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Fiscally Independent

Having the authority to raise revenue through taxation and make spending decisions independently, typically referring to governmental units.

CAFR

The Comprehensive Annual Financial Report, a set of U.S. government financial statements that provides a detailed presentation of a state, municipality, or other governmental entity's financial condition.

Introductory

Pertaining to the beginning or initial stage of something, often used to describe the initial phase of a project, course, or period.

Statistical

Refers to the use of mathematics, specifically the analysis and interpretation of numerical data, to gather insights or make inferences.

Q17: According to the U.S.Supreme Court,income may be

Q28: Karen is single and graduated from Marring

Q31: For each of the following situations,determine the

Q34: Fanny's employer has a qualified pension plan.The

Q56: Using the general tests for deductibility,explain why

Q86: The Ottomans own a winter cabin in

Q90: Roseanne sells her personal automobile for $1,000.The

Q117: Punitive damages<br>A)Dues,uniforms,subscriptions.<br>B)Intended to punish and are taxable.<br>C)Taxable

Q138: Which of the following individuals is involved

Q152: Janelle receives a sterling silver tea set