Wilson owns a condominium in Gatlinburg,Tennessee.During the current year,she incurs the following expenses before allocation related to the property:

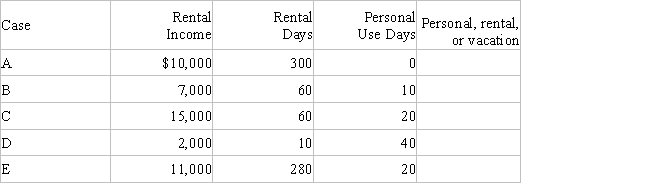

a.For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property,a rental or a vacation home.

b.Consider Case C.Determine Wilson's deductions related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Ulrich Beck

A German sociologist known for his work on the risk society, individualization, and reflexive modernization.

Zygmunt Bauman

A Polish sociologist known for his analyses of the links between modernity, globalization, and consumerism, as well as his concept of "liquid modernity".

Market Regulations

Rules established by a governing body to control the way markets operate, impacting how businesses function within them.

Cultural Imperialism

The spread and dominance of one culture's values, practices, and beliefs over others, often leading to the erosion of the dominated cultures.

Q4: Dean is a singer.After a singing engagement

Q7: Victor receives a $2,000 tax credit for

Q11: Waldo and Fern are negotiating a divorce

Q21: Which of the following business expenses is/are

Q35: For the past seven years Karen,an attorney,has

Q39: Some discontented taxpayers have suggested that complexity

Q67: Employers are required to pay a Federal

Q91: Which of the following statements concerning prizes

Q124: Conzo is injured in an accident while

Q153: Willis is a cash basis taxpayer who