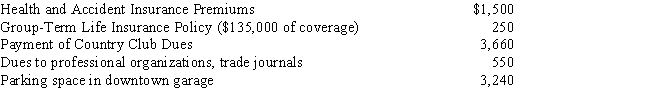

Summary Problem: Ralph,age 44,is an account executive for Cobb Advertising,Inc.Ralph's annual salary is $90,000.Other benefits paid by Cobb Advertising were:

In addition to the benefits above,Cobb Advertising has a qualified pension plan into which employees can contribute (and Cobb matches)up to 5% of their annual salary.Ralph contributes the maximum allowable to the plan.

Ralph has never been able to itemize his allowable personal deductions (i.e. ,he always uses the standard deduction).In 2017,Ralph receives a refund of $300 of his 2016 State income taxes and a 2016 Federal tax refund of $400.

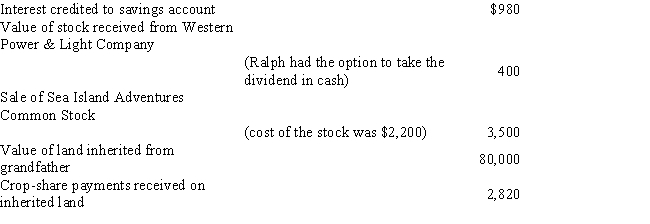

Other sources of income:

Required: Compute Ralph's 2016 gross income.

Definitions:

Transmission Electron Microscope

A type of electron microscope that provides highly magnified images by transmitting electrons through a specimen.

Scanning Electron Microscope

A type of electron microscope that produces images of a sample by scanning the surface with a focused beam of electrons.

Light Microscope

An instrument that uses visible light and magnifying lenses to examine small objects not visible to the naked eye.

Phospholipids

A class of lipids that are a major component of all cell membranes, forming lipid bilayers due to their amphipathic properties.

Q33: Oscar drives a taxi on weekends.In maximizing

Q45: After buying a new sofa at the

Q49: Monica's Lawn Service,Inc. ,purchases a heavy-duty tri-cut

Q57: Assignment of Income<br>A)Allocates income,losses,and deductions to its

Q70: Kiki fell asleep one night while driving

Q98: Accrual Method<br>A)Taxpayer reports income when received in

Q111: Active Trader<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q121: Health Savings Accounts are available only to

Q128: Which of the following payments meets the

Q140: Morris is considering investing in some bonds.Morris