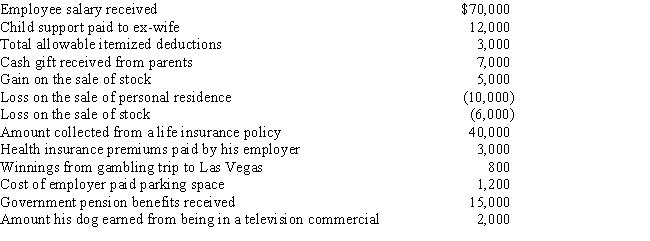

Summary Problem: Tommy,a single taxpayer with no dependents,has the following items that may affect his taxable income.What is his adjusted gross income?

Definitions:

Social Networks

Online platforms that allow users to build interpersonal relationships, share interests, activities, backgrounds, or real-life connections.

LinkedIn Page

A public profile on LinkedIn, the professional networking site, dedicated to businesses, organizations, or public figures to share updates, insights, and engage with followers.

Information Technologies

The use of computers, storage, networking, and other physical devices, infrastructure, and processes to create, process, store, secure, and exchange all forms of electronic data.

Loose Collection

Loose Collection refers to a group of items or elements that are gathered together without a strict organization or structure.

Q28: Which of the following payments is a

Q35: For the past seven years Karen,an attorney,has

Q42: Which of the following constitutes a realization?<br>I.Frank's

Q55: Which of the following production of income

Q60: Child & dependent care<br>A)An employee may exclude

Q63: Nonbusiness bad debt<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to

Q81: What type of tax rate structure is

Q94: Which of the following taxes paid by

Q103: Carl,age 59,and Cindy,age 49,are married and file

Q142: Mario is an employee of Flores Company.The