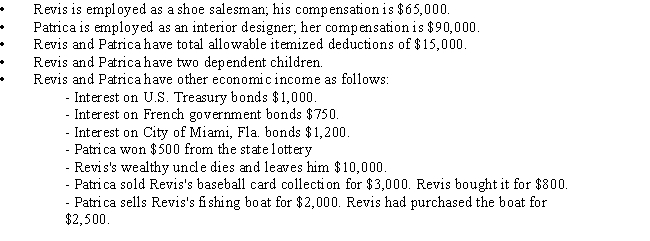

The information that follows applies to the current year for Revis and Patrica,a married couple.

Based on the above information,what is Revis and Patrica 's taxable income?

Definitions:

Public Airwaves

The radio frequency spectrum that is considered public property and is regulated by government agencies to ensure it is used in the public interest.

First Amendment

Part of the Bill of Rights in the United States Constitution, protecting freedom of speech, religion, press, assembly, and petition.

U.S. Constitution

The supreme law of the United States, establishing the framework of the national government, the division of powers, and the rights of citizens.

First Amendment

Part of the United States Constitution, guaranteeing freedoms concerning religion, expression, assembly, and the right to petition.

Q8: Rhonda and Ralph are married.Rhonda earns $81,000

Q13: All-Inclusive Income Concept<br>A)Taxpayer reports income when received

Q36: Political contributions<br>A)Capitalized and amortized over a number

Q56: Using the general tests for deductibility,explain why

Q58: Unemployment compensation<br>A)The category of income that includes

Q79: Cafeteria plan<br>A)An employee may exclude up to

Q91: Business bad debt expense<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited

Q135: Ursula owns an annuity that pays her

Q137: Ruth purchased an annuity contract for $10,000.When

Q159: Bart's spouse,Carla,dies during the current year.Carla's life