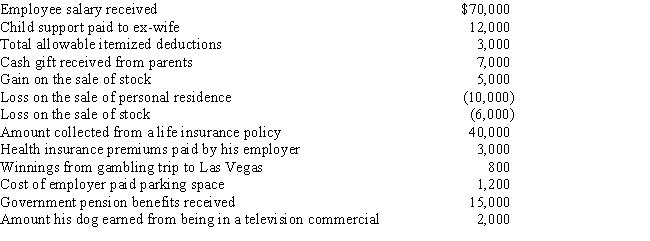

Summary Problem: Tommy,a single taxpayer with no dependents,has the following items that may affect his taxable income.What is his adjusted gross income?

Definitions:

Equal Slices

A method of dividing or allocating resources, goods, or profits evenly among all parties or members.

Corporate Stock Holdings

The shares of a corporation held by an individual, group, or another corporation, representing ownership interests.

Household Income

The total pre-tax earnings received by members of a household from all sources in a given period.

Greater Inequality

This term refers to an increasing gap between the wealthiest and the poorest portions of a population, which can impact socio-economic stability.

Q14: Alan has the following capital gains and

Q28: Karen is single and graduated from Marring

Q74: Harold is a 90% owner of National

Q87: David,an employee of Lima Corporation,is a U.S.citizen

Q90: Samantha is a self-employed electrician.During 2017,her net

Q111: Gloria owns 750 shares of the Greene

Q126: Explain the rationale for disallowing the deduction

Q130: Cornelius owns a condominium in Orlando.During the

Q150: John decides rather than work late in

Q165: Start-up costs over $5,000.<br>A)Capitalized and amortized over