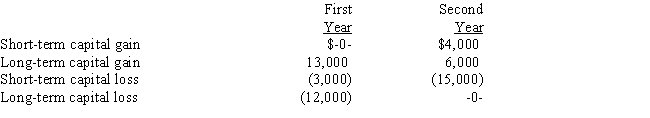

Given below are Belinda's capital gains and losses for two consecutive years.What is the effect of the gains and losses on Belinda's taxable income for each year?

First Second

Year Year

Definitions:

Integrative Bargaining

A negotiation strategy in which parties collaborate to find a win-win solution that satisfies the interests of both, often involving creative problem-solving.

Win-Win Solution

A conflict resolution outcome where all parties involved achieve their objectives and feel satisfied with the resolution.

Integrative Bargaining

A negotiation strategy that seeks to find mutually beneficial solutions by addressing the interests and needs of all parties involved, rather than focusing solely on winning or losing.

Acceptable Outcomes

Results or conclusions of actions, negotiations, or processes that are satisfactory to those involved or affected.

Q7: Assets are<br>A) Resources or information that is

Q19: Chad is a senior manager with Gusto,Inc.Chad's

Q91: Business bad debt expense<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited

Q97: Employment taxes are<br>A)revenue neutral.<br>B)regressive.<br>C)value-added.<br>D)progressive.<br>E)proportional.

Q111: Active Trader<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q114: List the criteria necessary for an expenditure

Q125: The hybrid method of accounting provides that

Q128: Andy lives in New York and rents

Q143: Which of the following expenditures are not

Q154: Premiums the insured taxpayer pays for life