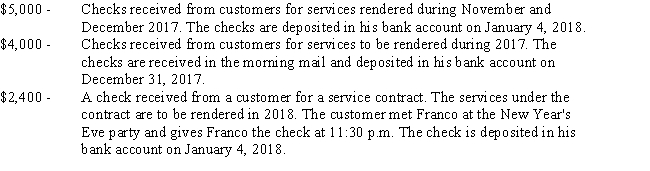

Franco is owner and operator of a cleaning service who uses the accrual method of accounting.He receives the following payments on December 31,2017,the last business day of his tax year:

How much of the $11,400 collected by Franco on December 31 must be included in his 2017 gross income?

Definitions:

Tangible Rewards

Physical or material rewards given as recognition for an accomplishment or behavior.

Intangible Rewards

Non-material incentives or motivational rewards that are not physically measurable, such as recognition or job satisfaction.

Intrinsic Benefits

Advantages or rewards that come inherently with an activity or action, not dependent on external factors.

Extrinsic Benefits

Rewards or advantages that come from external sources, not inherently related to the activity itself, but serving as motivations or bonuses.

Q1: Recognition<br>A)Taxpayer reports income when received in cash

Q5: The mythical country of Januvia imposes a

Q13: Writing the necessary data in the appropriate

Q15: Allowing individuals to deduct a standard deduction

Q21: To find the location of a file

Q22: When property is transferred,gift and estate taxes

Q43: Roscoe is a religion professor.During the summer,he

Q97: Sylvia is a United States citizen who

Q114: Laurie's Lawn Service,Inc. ,purchases a heavy-duty tri-cut

Q146: Roberto is a furniture salesman for Gerald's