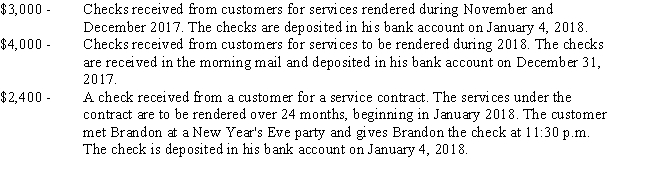

Brandon is the operator and owner of a cleaning service who uses the cash method of accounting.He receives the following payments on December 31,2017,the last business day of his tax year:

How much of the $9,400 collected by Brandon on December 31 must be included in his 2017 gross income?

Definitions:

Schizophrenia

A psychological condition marked by altered thought processes, emotional states, communication abilities, self-awareness, and actions.

Maturational Process

The natural progression of growth and development determined by genetic factors.

Expressed Emotion

A measure of the family environment based on how much criticism, hostility, and emotional overinvolvement are directed towards a family member, usually one with a psychiatric disorder.

Genetic Factors

Elements within an organism's genes that influence its traits and characteristics, potentially affecting its health, behavior, and physical appearance.

Q8: Limiting access to information system resources only

Q9: To view the contents of a folder,

Q13: Writing the necessary data in the appropriate

Q46: James bought an annuity for $42,000 several

Q53: Margarita,a single individual,has $2,000 in state taxes

Q54: Ellie has the following capital gains and

Q106: Alimony<br>A)The category of income that includes interest,dividends,and

Q114: List the criteria necessary for an expenditure

Q114: Laurie's Lawn Service,Inc. ,purchases a heavy-duty tri-cut

Q154: Premiums the insured taxpayer pays for life