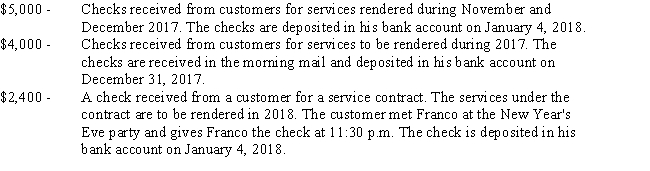

Franco is owner and operator of a cleaning service who uses the accrual method of accounting.He receives the following payments on December 31,2017,the last business day of his tax year:

How much of the $11,400 collected by Franco on December 31 must be included in his 2017 gross income?

Definitions:

Environmental Reporting

The practice of disclosing information about a company's environmental performance and impact to stakeholders, often part of corporate social responsibility reports.

Strategic Analysis

The process of conducting research on the business environment and the company itself to formulate strategy.

Environmental Concerns

Issues related to the natural environment due to human activities or processes, including pollution, natural resource depletion, and climate change.

Strategic Planning

The process of defining a company's direction and making decisions on allocating resources to pursue this direction.

Q3: The Sarbanes-Oxley act is important to information

Q3: As a threat action, social engineering is<br>A)

Q15: A tax provision has been discussed that

Q16: Phishing is<br>A) An activity performed by agents

Q46: Associated with<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q81: Ormont Corporation owed Landry Inc. ,$250,000.Ormont became

Q96: Mark and Cindy are married with salaries

Q103: In 2007,Gaylord purchased 100 shares of stock

Q104: Safina is a high school teacher.She has

Q143: Loss-of-income damages<br>A)Dues,uniforms,subscriptions.<br>B)Intended to punish and are taxable.<br>C)Taxable