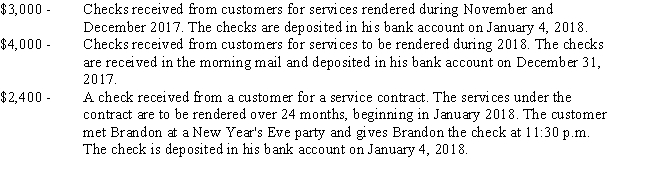

Brandon is the operator and owner of a cleaning service who uses the cash method of accounting.He receives the following payments on December 31,2017,the last business day of his tax year:

How much of the $9,400 collected by Brandon on December 31 must be included in his 2017 gross income?

Definitions:

Identity Development

The process through which individuals form, evolve, and reconcile aspects of their self-concept, such as personal identity and social roles.

Geek

Typically describes someone passionate about technology, science fiction, gaming, or other niche interests, often implying great expertise or enthusiasm.

Agreeable

A personality trait characterized by being pleasant, cooperative, and harmonious in social interactions.

Emotional Stability

A personality trait indicating the ability to remain calm and composed under stress, experiencing emotions without excessive negativity.

Q5: The mythical country of Januvia imposes a

Q8: Limiting access to information system resources only

Q10: ls -l output of "-rw-r--r-- 1 jon

Q20: Zeus and Spyeye are examples of<br>A) Viruses<br>B)

Q21: To find the location of a file

Q22: Systech offered its stockholders a choice between

Q57: Arnold is the President of Conrad Corporation.Arnold

Q76: Elise is a self-employed business consultant who

Q118: Which of the following taxpayers used tax

Q131: For a taxpayer to be engaged in