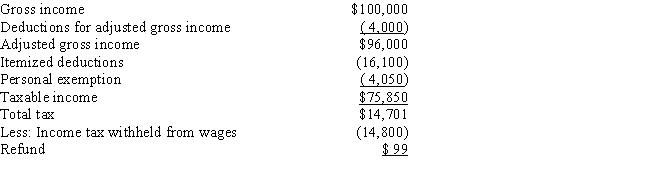

Sally is a single individual.In 2016,she receives $10,000 of tax-exempt income in addition to her salary and other investment income of $100,000.Sally's 2016 tax return showed the following information:

Which of the following statements concerning Sally's tax rates is (are) correct?

I.Sally's average tax rate is 19.4%.

II.Sally's average tax rate is 25.0%.

III.Sally's marginal tax rate is 25%.

IV.Sally's marginal tax rate is 28%.

Definitions:

Public Trading Companies

Corporations whose shares are listed and traded on public stock exchanges, making their ownership publicly accessible.

Adequate Capital

Sufficient funds required by a business to finance its operations and meet its obligations without facing financial distress.

Bank Run

A situation where a large number of a bank's customers try to withdraw their deposits simultaneously because they believe the bank might fail.

Canadian Deposit Insurance Corporation (CDIC)

A federal crown corporation in Canada that provides deposit insurance to protect the deposits made by consumers in member financial institutions in case of their failure.

Q1: In Windows, operating system log messages are

Q9: An incident response policy is<br>A) A description

Q13: An example of an absolute path is<br>A)

Q13: Security administrators use logs to<br>A) Analyze security

Q18: An example of a relative path is<br>A)

Q22: When property is transferred,gift and estate taxes

Q28: Cash Method<br>A)Taxpayer reports income when received in

Q47: The action research model is more _

Q112: For each of the following tax treatments,explain

Q129: Jessica is single and has a 2017