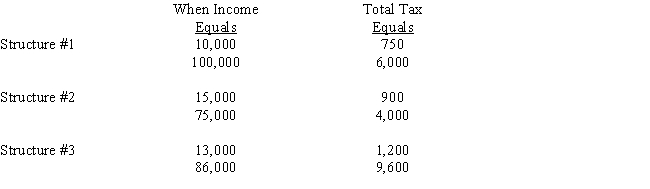

Indicate which of the following statements concerning the following tax rate structures is/are correct.

I.Tax Structure #1 is regressive.

II.Tax Structure #1 is proportional

III.Tax Structure #2 is progressive.

IV.Tax Structure #3 is progressive

Definitions:

Price-Value Formula

An equation or principle that reflects the relationship between the price of a product or service and the value it provides to the customer, aiming to establish what is considered fair or competitive.

Buyer's Thinking

The thought process and considerations of potential customers as they decide whether or not to purchase a product or service.

Price Objection

A concern or hesitation raised by a potential buyer about the cost of a product or service.

Economic Excuses

Reasons given for not purchasing a product or service based on financial constraints or budget considerations.

Q20: Cloud storage adds complexity to the work

Q21: Internal threat agents include<br>A) Partners and suppliers<br>B)

Q25: During incident response, volatile data refers to<br>A)

Q53: Anna receives a salary of $42,000 during

Q57: Current period expenditure incurred in order to

Q61: Mo is a single taxpayer reporting $95,000

Q69: Explain why the taxpayer in each of

Q88: Entity Concept<br>A)Allocates income,losses,and deductions to its owners

Q118: Sarah is single and retires in 2017.During

Q141: Baron pays $4,000 in legal fees.Under what