The mythical country of Woodland imposes two taxes:

Worker tax: Employers withhold ten percent of all wages and salaries.If taxable income as reported on the employee's income tax return is greater than $40,000,an additional 5% tax is levied on all income.

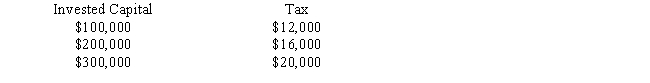

Business tax: All businesses pay a tax on invested capital based on a valuation formula.The tax computed for three different amounts of invested capital is provided below:

According to the definitions in the text:

I.The worker tax is a regressive tax rate structure.

II.The business tax is a progressive tax rate structure.

III.The worker tax is a progressive tax rate structure.

IV.The business tax is a regressive tax rate structure.

Definitions:

Serial Bonds

Bonds that mature in installments over a period rather than having a single maturity date.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board that serve as a global framework for preparing financial statements.

GAAP

Generally Accepted Accounting Principles, a common set of accounting rules and standards used in the United States for financial reporting.

Detachable Warrants

Warrants issued with another security that can be separated from the security and sold independently.

Q5: Discuss a variety of skills and competencies

Q9: Information security professional do not report spending

Q15: OpenID uses an<br>A) Insecure model of authentication<br>B)

Q16: From the perspective of information security, the

Q16: The parameters used to characterize assets are<br>A)

Q18: A PIN is<br>A) A short numerical password<br>B)

Q34: Fanny's employer has a qualified pension plan.The

Q45: Property settlement<br>A)The category of income that includes

Q69: Explain why the taxpayer in each of

Q137: The income tax treatment of damages received