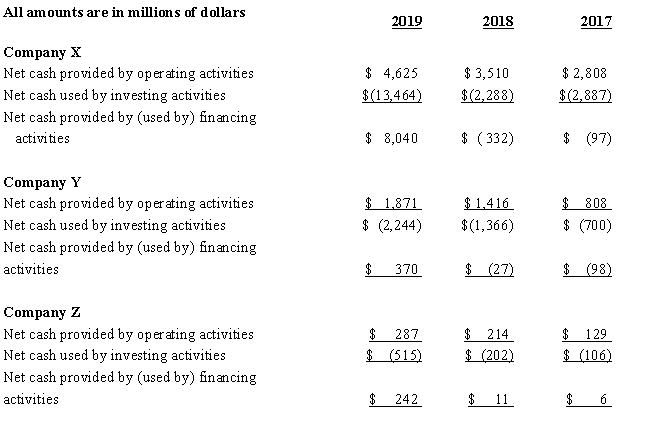

Use the selected information from the statement of cash flows for three actual companies for the last three years to answer the questions that follow.

-

Required

Ignoring the differences in magnitude,comment on the similarities and differences in the cash flows of the three companies.

Definitions:

Capital in Excess of Par

The amount by which the proceeds from the issuance of shares exceed the par value of the shares issued; it's often referred to as additional paid-in capital.

Debt-Equity Ratio

A measure of a company's financial leverage calculated by dividing its total liabilities by stockholders' equity.

Residual Dividend Policy

A strategy where dividends paid to shareholders are set based on the earnings left over after all operational costs and working capital needs are met.

Retained Earnings

Profits that a company has decided to keep or reinvest in the business instead of distributing to shareholders as dividends.

Q27: With the effective interest method of amortization,the

Q76: A company has $8,000 in cash,$9,250 in

Q86: Which category of cash flows-operating,investing,or financing activities-do

Q95: Under the indirect method,a loss from the

Q122: Refer to Exhibit 39-1.At the support price

Q123: Book value indicates the rights that stockholders

Q156: The Discount on Bonds Payable account is

Q162: If a company's bonds are callable,<br>A)the investor

Q182: Cash flows from operating activities usually relate

Q186: The statement of stockholders' equity<br>A)is one of