Cheswick Corp.

The following information is for Cheswick Corp. at the end of 2017:

-Refer to the data for Cheswick Corp..

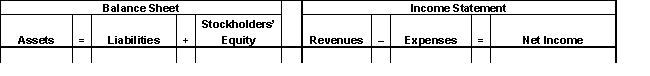

Determine the effect on Cheswick Corp.' accounting equation of the year-end adjustment of bad debts using the aging approach.

Definitions:

Actuarially Determined

Calculated using actuaries' methods and assumptions, typically in the context of pension plans and insurance.

Discount Rate

The interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows or investments.

Pension Plan

A retirement plan that requires an employer to make contributions into a pool of funds set aside for a worker's future benefit.

Cumulative Unrecognized Loss

Losses that have not been realized through a transaction and are not reflected in financial statements, often relating to investments or assets held.

Q17: How are cash equivalents reported or disclosed

Q24: Which of the following procedures is incorrect

Q80: Refer to the account information for Hanover,Inc.<br>?<br>Required<br>?Compute

Q97: Marsh Corporation borrowed $90,000 by issuing a

Q104: How should intangible assets be disclosed on

Q119: <br>Checks are issued by designated officers in

Q132: Explain what costs are included in the

Q148: Mayflower Company had a machine with a

Q161: The comparative financial statements for the

Q175: Hemmer Company received a 12%,six-month promissory