Tiva Solutions’ accounting records reflect the following account balances at December 31, 2017:

During 2017, the following transactions occurred:

1. On March 1, purchased a one-year insurance policy for $1,200 cash.

2. On April 1, borrowed $10,000 cash from Rock City Bank. The interest rate on the note payable is 6%.

Principal and interest is due in cash in one year.

3. Employee salaries in the amount of $20,000 were paid in cash.

4. At the end of the year, $400 of the supplies remained on hand.

5. Earned $45,000 in tax consulting revenue during 2017 in cash.

6. At December 31, $5,000 in employee salaries were accrued.

7. On December 31, received $2,000 in cash representing advance payment for services to be provided in February 2018.

8. The building has a useful life of 25 years and no salvage value.

The building has a useful life of 25 years and no salvage value.

Required

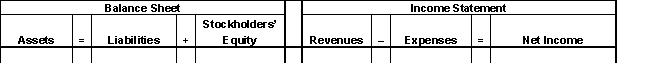

A. Determine the effect on the accounting equation of the preceding transactions including any related year-end adjusting entries that may be required. Create a table to reflect the increases and decreases in accounts.

B. Prepare an income statement for Tiva Solutions for 2017. Ignore income tax effects.

B. Prepare an income statement for Tiva Solutions for 2017. Ignore income tax effects.

C. Prepare a classified balance sheet for Tiva Solutions at December 31, 2017.

Definitions:

Adolescence

The transitional stage of physical and psychological development that occurs between childhood and adulthood, characterized by significant growth and change.

Clinically Depressed Patients

Individuals diagnosed by healthcare professionals as having major depressive disorder, characterized by persistent sadness and a lack of interest or pleasure in daily activities.

Psychotherapy

A form of therapy that involves talking with a therapist to address and manage psychological issues or disorders.

Drug Therapy

The treatment of disease through the administration of drugs or medications to achieve a therapeutic effect.

Q14: Matching can occur directly (like cost of

Q54: An entry made to the right side

Q72: For each of the following,calculate the

Q84: Jackson Transportation purchases many pieces of office

Q94: Measurement in accounting requires choosing an attribute

Q121: Recognition is the process of formally recording

Q132: The buyer must include goods purchased FOB

Q158: _ and _ have claims to an

Q179: With the periodic inventory system,the Inventory account

Q202: A question asked by stockholders is,"How much