Presented below are several accounts from the financial statements of Eagle, Inc. for the year ended December 31, 2017:

1. Cash

2. Accounts Receivable

3. Prepaid Expenses

4. Accounts Payable

5. Common Stock

6. Sales

7. Selling Expenses

8. Administrative Expenses

9. Interest Expense

10. Income Taxes Expense

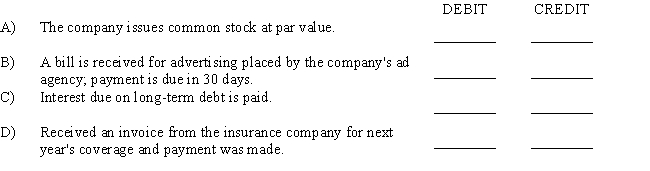

Each of these accounts has been assigned an identification number that you will use as answers for the transactions described below.Enter the account number(s)in the blank spaces under the headings DEBIT and CREDIT to indicate the accounts debited and credited when each transaction is recorded in a general journal.

Definitions:

Breach

The violation or failure to observe a legal agreement, law, or obligation.

Specific Performance

is a legal remedy in contract law where a court orders a party to perform their contractual duties, rather than simply paying damages for failing to fulfill the contract.

Seller

A seller is an individual or entity that offers goods or services for sale.

Identified Goods

Identified goods are specific items that have been designated or set aside for a particular contract or sale, distinct from others.

Q40: The statement of cash flows reflects the

Q41: Sherman,Inc.counted its ending inventory as $178,000

Q42: The initial step in the recording process

Q53: What is the name of the branch

Q117: Unfortunately,the bookkeeper notices that two transactions for

Q122: Read the information for Taryn Corporation and

Q157: The bookkeeper for B.Sebastian & Company,Inc.prepared

Q161: Rogers Corporation starts the year with a

Q173: How is the balance sheet linked to

Q174: Presented below is a partially completed