Use the table for the question(s) below.

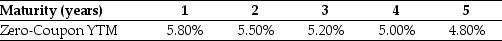

Consider the following zero-coupon yields on default-free securities:

-The forward rate for year 2 (the forward rate quoted today for an investment that begins in one year and matures in two years) is closest to:

Definitions:

Central Bank

An institution designed to oversee the banking system, regulate the quantity of money in the economy, and provide various financial services to the government.

Treasury Bonds

Long-term government debt securities with a fixed interest rate, considered low-risk investments.

Required Reserves

The minimum amount of deposits that a bank must hold in reserve and not lend out, as mandated by central banking regulations.

Excess Reserves

The amount of reserves that banks hold beyond the required minimum to meet potential withdrawals by customers.

Q8: Another oil refiner is offering to trade

Q55: The unlevered value of Aardvark's new project

Q58: The profitability index for this project is

Q72: How does scenario analysis differ from sensitivity

Q73: The NPV for Epiphany's Project is closest

Q76: If the appropriate discount rate for this

Q82: Assuming that Casa Grande Farms depreciates these

Q84: What is the role of an auditor

Q90: Which of the following is NOT a

Q91: You are considering adding a microbrewery on