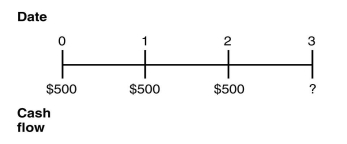

Consider the following timeline:  If the current market rate of interest is 7%,then the future value of this timeline as of year 3 is closest to:

If the current market rate of interest is 7%,then the future value of this timeline as of year 3 is closest to:

Definitions:

Minimum Lease Payments

The lowest amount that a lessee is obligated to pay over the lease term, excluding costs for services such as insurance and maintenance.

Operating Lease

An operating lease is an agreement allowing someone to use an asset without ownership, typically for shorter periods, and expenses are recorded as operating expenses.

Implicit Interest Rate

The interest rate that can be inferred from the terms of a lease or loan, reflecting the true cost of borrowing when the interest rate is not explicitly stated.

Straight-line Method

A depreciation technique that allocates an equal amount of the asset's cost to each year of the asset's useful life.

Q5: Which alternative offers you the lowest effective

Q5: Assuming that Luther's bonds receive a AAA

Q13: Gross profit is calculated as:<br>A)Total sales -

Q22: Luther's Operating Margin for the year ending

Q34: Assume that THSI's cost of capital for

Q52: Wyatt Oil has a net profit margin

Q65: The effective tax disadvantage for retaining cash

Q81: The price per share of the ETF

Q91: Which of the following is NOT a

Q93: Which of the following statements is FALSE?<br>A)Given