Use the following information to answer the question(s)below.

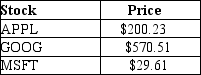

An exchange traded fund (ETF)is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of Apple Inc.(APPL),one share of Google (GOOG),and ten shares of Microsoft (MSFT).Suppose the current stock prices of each individual stock are as shown below:

-If the ETF is currently trading for $1200,what arbitrage opportunity is available? What trades would you make?

Definitions:

Average Provincial Tax Rate

The Average Provincial Tax Rate is the average rate of tax imposed by a province on income, which can vary depending on the income level and specific province.

Average Tax Rate

The ratio of total taxes paid to total income, representing the percentage of income paid in taxes.

Capital Gains

The profit earned from the sale of an asset that has increased in value over the holding period, subject to taxation.

Non-Eligible Dividends

Dividends paid from income that has not been taxed at the corporate level, often subject to a different tax rate on the recipient's end.

Q4: The weighted average cost of capital for

Q7: Assume that five years have passed since

Q7: Assuming that Ideko has a EBITDA multiple

Q8: Suppose the interest rate is 9% APR

Q16: What range for the market value of

Q27: Given that Rose issues new debt of

Q39: IF FBNA increases leverage so that its

Q68: If your new strip mall will have

Q79: You have an investment opportunity in Germany

Q82: Wyatt Oil is contemplating issuing a 20-year