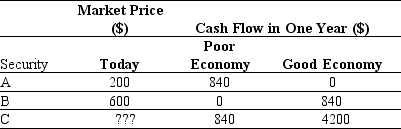

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,what risk premium is appropriate for this security?

Definitions:

R00.0

Tachycardia, unspecified; a code representing abnormally rapid heart rate.

Ventricular Septal Defect

A heart defect due to an abnormal connection between the lower chambers of the heart (ventricles), leading to blood flow between them.

Q21.0

A code in the International Classification of Diseases, specifically denoting certain congenital malformations of the cardiac septa.

Arrhythmia

An irregular heartbeat, which can feel like a racing heart or fluttering, and can be harmless or a sign of a serious heart condition.

Q11: The amount of net working capital for

Q13: What is one of the incremental IRRs

Q30: The NPV of this project using the

Q43: Calculate the debt capacity of Omicron's new

Q49: Assume that EGI decides to raise the

Q53: The Internal Rate of return of this

Q70: Absent any other trading frictions or news,Rearden's

Q71: Assume that management makes a surprise announcement

Q78: The change in Luther's quick ratio from

Q82: Wyatt Oil is contemplating issuing a 20-year