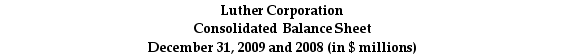

Use the table for the question(s) below.

Consider the following balance sheet:

-When using the book value of equity,the debt to equity ratio for Luther in 2009 is closest to:

Definitions:

Monthly Compounding

An interest calculation method where the accrued interest is added to the principal sum every month, leading to an increase in the amount of subsequent interest accruements.

Effective Rate

The actual interest rate earned or paid on an investment or loan, taking into account the compounding of interest.

Quarterly Compounding

Interest calculation that occurs four times a year, effectively increasing the amount of interest accrued over time.

Effective Rate

The interest rate on a loan or financial product that reflects the compounding periods in a year, presenting a true annual rate of return.

Q6: The amount of Rosewood's interest tax shield

Q12: The credit spread on BBB-rated corporate bonds

Q26: Calculate Luther's return of equity (ROE),return of

Q45: In addition to the balance sheet,income statement,and

Q53: Consider the following formula:<br>R<sub>wacc</sub> = <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6458/.jpg"

Q59: If the risk-free interest rate is 10%,then

Q62: Suppose Luther Industries is considering divesting one

Q66: Assuming that Palin's cost of capital is

Q68: Assume that Omicron uses the entire $50

Q81: The firm's equity multiplier measures:<br>A)the value of