Use the information for the question(s) below.

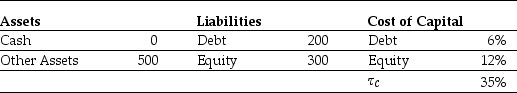

Omicron Industries' Market Value Balance Sheet ($ Millions)

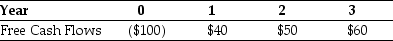

and Cost of Capital  Omicron Industries New Project Free Cash Flows

Omicron Industries New Project Free Cash Flows  Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

Assume that this new project is of average risk for Omicron and that the firm wants to hold constant its debt to equity ratio.

-Omicron's weighted average cost of capital is closest to:

Definitions:

Receivables Turnover

A financial metric that measures how efficiently a company collects cash from its credit sales by dividing credit sales by the average accounts receivable.

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets.

Working Capital

A financial metric representing the difference between a company's current assets and current liabilities.

Current Liabilities

Short-term financial obligations due within one year or less, which a company needs to pay with its current assets.

Q12: Assume that in addition to 1.25 billion

Q17: Which of the following statements regarding the

Q29: Accounts payable is a:<br>A)long-term liability.<br>B)current asset.<br>C)long-term asset.<br>D)current

Q46: The Sarbanes-Oxley Act (SOX)overhauled incentives and the

Q52: Which of the following stocks represent selling

Q53: Which of the following statements is FALSE?<br>A)The

Q81: The forward rate for year 5 (the

Q84: What is the role of an auditor

Q87: What is the NPV of this project

Q92: Assuming that Luther has no convertible bonds