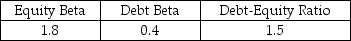

Use theUse the firm has only been listed on the stock exchange for a short time,you do not have an accurate assessment of Nielson's equity beta.However,you do have the following data for another firm in the same industry:  Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

Nielson has a much lower debt-equity ratio of .5,which is expected to remain stable,and Nielson's debt is risk free.Nielson's corporate tax rate is 21%,the risk-free rate is 5%,and the expected return on the market portfolio is 10%.

-Nielson's estimated equity beta is closest to:

Definitions:

Marketing Mix

The combination of factors that can be controlled by a company to influence consumers to purchase its products, traditionally identified as product, price, place, and promotion.

Market Share

The proportion of the overall sales in a market that a company, product, or brand secures.

Externally Focused Strategies

Business tactics that prioritize external market conditions and customer needs over internal considerations.

Internally Focused Strategies

Approaches within a business that concentrate on improving internal processes, resources, and capabilities to meet organizational goals and objectives.

Q12: Which of the following statements is FALSE?<br>A)The

Q18: Suppose that to fund this new project,Aardvark

Q19: If ECE reported $15 million in net

Q31: Which of the following statements is FALSE?<br>A)The

Q40: Based upon Ideko's Sales and Operating Cost

Q43: If the risk-free interest rate is 10%,then

Q59: Given that Rose issues new debt of

Q59: Assume that you are an investor with

Q64: Assume that in the event of default,20%

Q82: Assume that EGI decides to wait until