Use the following information to answer the question(s) below.

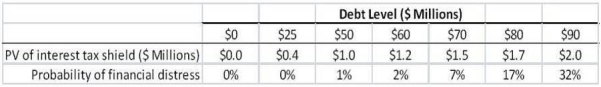

d'Anconia Copper is considering issuing one-year debt,and has come up with the following estimates of the value of the interest tax shield and the probability of distress for different levels of debt:

-If in the event of distress,the present value of distress costs is equal to $5 million,then the optimal level of debt for d'Anconia Copper is:

Definitions:

Mere Exposure

A psychological phenomenon where people tend to develop a preference for things merely because they are familiar with them.

Anxious Attachment

A style of attachment characterized by a strong fear of being abandoned by the relationship partner and a desire to maintain closeness.

Imprinting

An innate form of learning within a critical period early in an animal's life where it forms attachments and recognizes certain stimuli as essential.

Insecure Attachment

A type of attachment characterized by fear, anxiety, or avoidance in relationships, stemming from inconsistent or negative early experiences with caregivers.

Q5: Which of the following statements is FALSE?<br>A)Even

Q7: Suppose you are a shareholder in d'Anconia

Q10: The NPV for Omicron's new project is

Q37: The free cash flow to equity in

Q53: The e<sub>i</sub> in the regression:<br>A)measures the market

Q54: Which of the following statements is FALSE?<br>A)The

Q62: Suppose Luther Industries is considering divesting one

Q67: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6458/.jpg" alt="The term

Q82: The amount of additional cash that d'Anconia

Q98: In practice which market index is most