Use the following information to answer the question(s) below.

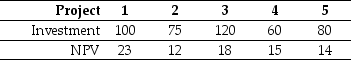

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-The total debt overhang associated with accepting project 4 is closest to:

Definitions:

First-in

Typically refers to the "First-In, First-Out" (FIFO) inventory method where the oldest inventory items are recorded as sold first.

Conversion Costs

The costs required to convert raw materials into finished goods, including direct labor and manufacturing overhead.

Equivalent Unit

A concept used in cost accounting to convert the amount of work done on partially finished goods into the equivalent of complete goods.

First-in

Typically refers to the "First-in, First-out" (FIFO) inventory method, where goods that are first produced or acquired are the first ones to be sold.

Q1: If Flagstaff currently maintains a .8 debt

Q15: Consider the following equation for the Project

Q22: Omicron's Unlevered cost of capital is closest

Q53: The Internal Rate of return of this

Q54: Assume the following tax schedule:<br>Personal Tax Rates<br>

Q58: Which of the following formulas regarding NPV

Q68: Which of the following statements is FALSE?<br>A)One

Q72: The initial value of MI's equity without

Q77: You have an $8000 balance on your

Q95: Which of the following statements is FALSE?<br>A)To