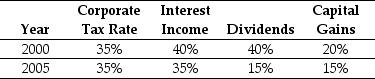

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2000,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (t*) was closest to:

Definitions:

Net Income Determination

The process of calculating a company's total earnings after subtracting all expenses, including taxes and costs, from total revenues.

Accrual Accounting

An accounting method that records revenues and expenses when they are incurred, regardless of when cash transactions occur.

Cash Basis

An accounting method where revenues are recognized when cash is received and expenses are recognized when paid.

Costs Expire

This concept relates to the recognition of expenses in the income statement when the underlying value or utility of the cost is consumed or no longer exists.

Q12: Rose Industries has a $20 million loan

Q45: What range for the market value of

Q48: Which of the following statements is FALSE?<br>A)Holding

Q56: Suppose that d'Anconia Copper retained the $200

Q59: Assume that you are an investor with

Q68: Assume that Omicron uses the entire $50

Q72: The geometric average annual return on the

Q73: The value of Luther with leverage is

Q88: Which of the following statements is FALSE?<br>A)Securities

Q121: Which of the following statements is FALSE?<br>A)When