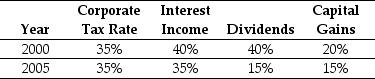

Use the table for the question(s) below.

Consider the following historical top federal tax rates in the United States:

Personal Tax Rates

-In 2005,assuming an average dividend payout ratio of 50%,the effective tax advantage for debt (τ*) was closest to:

Definitions:

Duty to Have

An obligation or requirement to possess something, often related to legal, regulatory, or professional standards.

Partnership Agreement

A legal document that outlines the rights, responsibilities, and profit-and-loss distribution among partners in a business partnership.

Division of Profits

The allocation of a company's net profits among its shareholders or partners.

Partnership Business

A type of business structure in which two or more individuals share ownership, profits, liabilities, and responsibilities.

Q1: Assuming that the risk-free rate is 4%

Q3: Which of the following statements is FALSE?<br>A)When

Q17: A type of agency problem that results

Q23: Which of the following statements is FALSE?<br>A)Nonzero

Q28: Assuming that Ideko has a EBITDA multiple

Q66: Which of the following statements is FALSE?<br>A)All

Q79: The effective tax disadvantage for retaining cash

Q91: Iota's weighted average cost of capital is

Q93: Suppose that Iota is able to invest

Q97: Which of the following statements is FALSE?<br>A)The