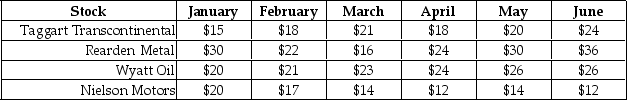

Use the following information to answer the question(s) below.

Consider the price paths of the following stocks over a six-month period:  None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of March,which stocks are you most inclined to hold? 1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Capital Asset Pricing Model

The Capital Asset Pricing Model is a formula used to determine the expected return on an investment based on its risk relative to the overall market.

Retained Earnings

Retained earnings are the portion of a company's profits that are kept or retained rather than being paid out as dividends to shareholders, used for reinvestment in the business, debt reduction, or other purposes.

Cost of Equity

The return that investors expect for investing in a company's equity, often calculated using models such as the Capital Asset Pricing Model (CAPM).

Floatation Costs

Expenses incurred by a company in issuing new securities, including underwriting fees, legal fees, and registration fees.

Q4: If Rosewood had no interest expense,its net

Q8: Luther's Unlevered cost of capital is closest

Q48: Suppose that BBB pays corporate taxes of

Q51: After the repurchase how many shares will

Q66: Which of the following is NOT an

Q67: Which of the following is true of

Q73: If KT expects to maintain a debt

Q79: Which of the following statements is FALSE?<br>A)Given

Q101: Assume that in the event of default,20%

Q121: Which of the following statements is FALSE?<br>A)When