Use the following information to answer the question(s) below.

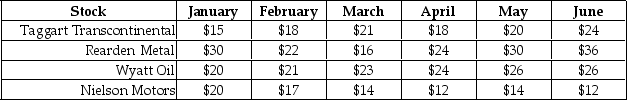

Consider the price paths of the following stocks over a six-month period:  None of these stocks pay dividends.

None of these stocks pay dividends.

-Assume that you are an investor with the disposition effect and you bought each of these stocks in January.Suppose that it is currently the end of June,which stocks are you most inclined to sell? 1.Taggart Transcontinental

2.Rearden Metal

3.Wyatt Oil

4.Nielson Motors

Definitions:

Test Period

A specific duration of time designated for the purpose of conducting tests, assessments, or experiments to evaluate performance, effectiveness, or reliability.

Histogram

A graphical representation of the distribution of numerical data, usually shown as bars of different heights.

Positively Skewed

Describes a distribution of numerical data where the right tail is longer or fatter than the left, indicating that the majority of values are concentrated on the left side of the distribution.

Negatively Skewed

Describes a distribution where the tail is on the left side of the distribution, indicating that the majority of data points are concentrated on the right side.

Q4: Which of the following statements is FALSE?<br>A)Expected

Q9: Aardvark's unlevered cost of equity is closest

Q10: Which of the following statements is FALSE?<br>A)On

Q13: Consider the production possibility frontier of an

Q31: Which of the following statements is FALSE?<br>A)The

Q32: Suppose you invest $15,000 in Merck stock

Q50: Which of the following statements is FALSE?<br>A)Whether

Q55: Which of the following statements is FALSE?<br>A)Because

Q71: The standard deviation for the return on

Q81: Which of the following statements is FALSE?<br>A)Aside