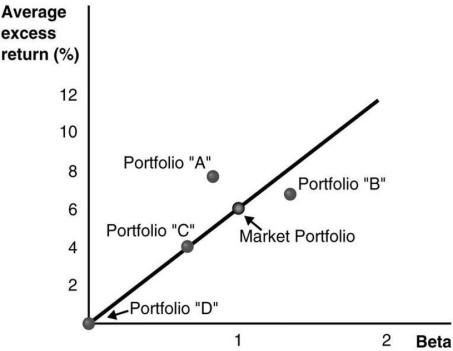

Use the figure for the question(s) below.Consider the following graph of the security market line:

-Which of the following statements regarding portfolio "B" is/are correct? 1.Portfolio "B" has a positive alpha.

2.Portfolio "B" is overpriced.

3.Portfolio "B" is less risky than the market portfolio.

4.Portfolio "B" should not exist if the market portfolio is efficient.

Definitions:

Pre-acquisition Retained Earnings

The accumulated profits of a company before it was acquired by another entity, which are not included in the calculation of goodwill.

Consolidation Worksheet

A document used in preparing consolidated financial statements that combines the financial data of parent and subsidiary companies.

Revalued Above Cost

When an asset's market value increases beyond its historical cost, leading to an adjustment in the book value.

Goodwill

An intangible asset that arises when a company acquires another business for more than the fair value of its identifiable net assets.

Q2: What is the excess return for the

Q8: Which of the following statements is FALSE?<br>A)When

Q21: A stock's _ measures the stock's return

Q33: If the expected return on the market

Q35: Your estimate of the debt beta for

Q42: The firm will pay the dividend to

Q54: Which of the following statements is FALSE?<br>A)The

Q62: Assuming your cost of capital is 6

Q71: The overall asset beta for Wyatt Oil

Q98: The Free Cash Flow to Equity (FCFE)for