Use the table for the question(s) below.

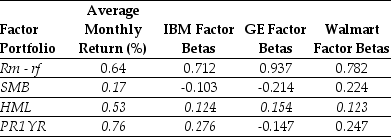

Consider the following information regarding the Fama-French-Carhart four factor model:

-Using the FFC four factor model and the historical average monthly returns,the expected monthly return for IBM is closest to:

Definitions:

Positively Correlated

A relationship between two variables where one variable increases as the other also increases.

Height

The measurement of someone or something from head to foot or from base to top.

Weight

A measure of the heaviness of an object, often quantified using units like pounds or kilograms.

Positively Correlated

A relationship between two variables in which both variables move in the same direction.

Q21: A stock's _ measures the stock's return

Q30: Macroeconomics deals primarily with:<br>A)aggregate economic factors.<br>B)the behavior

Q56: Show mathematically that the stock price of

Q57: Which of the following statements is FALSE?<br>A)A

Q59: The unlevered beta for Lincoln is closest

Q66: The effective dividend tax rate for a

Q69: Which of the following statements is FALSE?<br>A)Personal

Q76: Assume that Omicron uses the entire $50

Q96: Suppose that you are holding a market

Q130: Which of the following statements is FALSE?<br>A)Margin