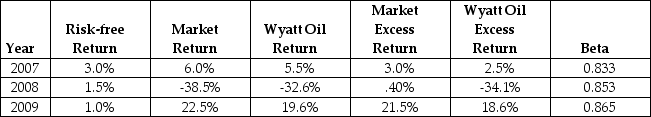

Use the following information to answer the question(s) below.

-Using the average historical excess returns for both Wyatt Oil and the Market portfolio estimate of Wyatt Oil's Beta.When using this beta,the alpha for Wyatt oil in 2007 is closest to:

Definitions:

Value of Each Share

The worth of a single share of stock in a company, determined by the market or through valuation techniques.

Residual Dividend Policy

A strategy where dividends are paid out from the residual or leftover equity after all necessary operating expenses and working capital needs are met.

Investment Needs

The financial goals or objectives that require the allocation of capital in securities or assets.

Dividends

Regular payments made by a corporation to its shareholders out of its profits or reserves.

Q4: Which of the following statements is FALSE?<br>A)Portfolios

Q24: The interest rate tax shield for Kroger

Q31: Which one of the following represents an

Q35: Assume that investors in Google pay a

Q45: When all investors correctly interpret and use

Q47: At every point on an individual's demand

Q71: Suppose that California Gold Mining's expected return

Q82: The beta for the portfolio of the

Q84: The beta for the market is closest

Q86: The total market capitalization for all four