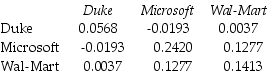

Use the table for the question(s) below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Duke Energy and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

New Consumption Patterns

Emerging trends in the way consumers purchase and use goods and services, often driven by changes in technology, culture, or economic factors.

Market Attractiveness

The degree to which a market is appealing to a company, considering factors like size, profitability, and competition.

Marketing Mix

A combination of factors that can be controlled by a company to influence consumers to purchase its products, traditionally identified as product, price, place, and promotion.

Market Attractiveness

An evaluation metric used to assess the potential for profit and success in a particular market or segment, considering factors like size, growth, and competition.

Q2: Which of the following organization forms accounts

Q18: The opportunity cost of a good is

Q47: Suppose that to raise the funds for

Q57: Assume that investors hold Google stock in

Q59: Wyatt Oil's average historical excess return is

Q63: Which of the following is an example

Q71: Raceway Products has a market debt-to-equity ratio

Q82: The beta for the portfolio of the

Q97: Explain how having different interest rates for

Q101: Suppose that you have invested $30,000 in