Use the following information to answer the question(s) below.

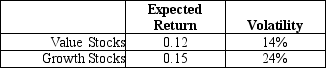

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The Sharpe ratio for the value stock portfolio is closest to:

Definitions:

Population Variances

A measure of the dispersion or spread of a set of data points within a population, indicating how much the numbers differ from the population mean.

Sample Mean Difference

Sample mean difference is the arithmetic difference between the means of two samples, used to compare their central tendencies.

Mean Playing Times

The average duration of play sessions across a defined set of games or activities, calculated by summing all individual playing times and dividing by the number of sessions.

Significance Level

A statistical measure that defines the threshold at which a hypothesis test's result is considered statistically significant, typically denoted as alpha (α).

Q11: Which of the following statements is FALSE?<br>A)If

Q15: In 2005,the effective tax rate for debt

Q19: Two separate firms are considering investing in

Q21: Positive economics differs from normative economics in

Q29: The cost of capital for a project

Q34: Suppose you are a shareholder in Galt

Q38: Various trading strategies appear to offer non-zero

Q60: Which of the products described below is

Q85: California Gold Mining's beta with the market

Q89: The variance of the returns on Stock