Use the following information to answer the question(s) below.

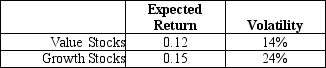

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The expected return on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Purchase Agreement

A legal contract outlining the terms and conditions related to the purchase of goods, services, or property.

Inventory Carrying Costs

The total expenses associated with holding and storing unsold goods, including warehousing, handling, insurance, and opportunity costs.

Raw Materials

The basic materials from which products are created, typically unprocessed or minimally processed substances used in manufacturing.

Manufacturing

The process of converting raw materials into finished goods on a large scale using labor, machines, tools, and chemical or biological processing.

Q1: Following the borrowing of $12 million and

Q4: The expected return of a portfolio that

Q6: The cost of _ is highest for

Q18: Using the FFC four factor model and

Q30: Investors that suffer from a familiarity bias:<br>A)prefer

Q79: Assume that you have $250,000 to invest

Q89: Which of the following statements is FALSE?<br>A)A

Q90: In an effort to deter alcohol consumption

Q91: Do expected returns for individual stocks increase

Q94: Please answer the following:<br>a)Peter and Pip both