Use the following information to answer the question(s) below.

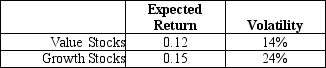

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio) : growth stocks and value stocks.Assume that these two portfolios are equal in size (market value) ,the correlation of their returns is equal to 0.6,and the portfolios have the following characteristics:  The risk-free rate is 3.5%.

The risk-free rate is 3.5%.

-The volatility on the market portfolio (which is a 50-50 combination of the value and growth portfolios) is closest to:

Definitions:

Q5: An agency problem can be alleviated by:<br>A)requiring

Q5: The term <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6458/.jpg" alt="The term

Q11: What are your net proceeds if you

Q37: A _ is when a rich individual

Q46: Which of the following is not likely

Q66: Suppose the government levies a tax on

Q84: Consider two goods,X and Y.If the price

Q91: Do expected returns for individual stocks increase

Q94: Wyatt's annual interest tax shield is closest

Q95: Which of the following statements is FALSE?<br>A)To