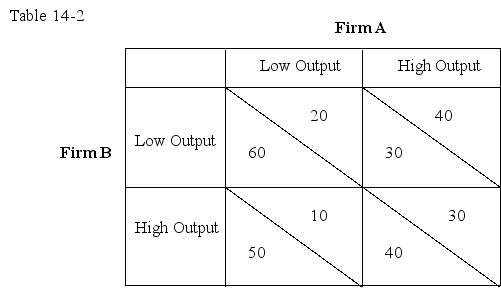

Use the following table to answer the question : Table 14-2 : represents the payoff matrix of firms A and B,when they choose to produce low or high output.In each cell,the figure on the left indicates Firm B's payoffs and the figure on the right indicates Firm A's payoffs.

-Refer to Table 14-2.Which of the following statements about the two firms must be true?

Definitions:

Market Risk Premium

The bonus yield an investor projects to receive by placing their money in a risky market portfolio instead of in assets that carry no risk.

Market Rate

The prevailing interest rate available in the marketplace.

Individual Security

A particular financial instrument such as a stock or bond representing an ownership or creditor relationship with a corporation or governmental entity.

Portfolio Beta

A measure of the volatility, or systematic risk, of a portfolio of investments compared to the market as a whole.

Q4: Given the information in Table 14-3,if X

Q14: In which of the following situations would

Q20: The following figure shows the marginal revenue

Q28: In Table 16-1,marginal returns from labor diminishes

Q37: Using a graph,explain the employment effects of

Q45: Which of the following is true of

Q58: Assume that coffee shops operate in a

Q60: Which of the following can be concluded

Q72: A point off the contract curve in

Q72: The perfectly competitive firm maximizes profits by