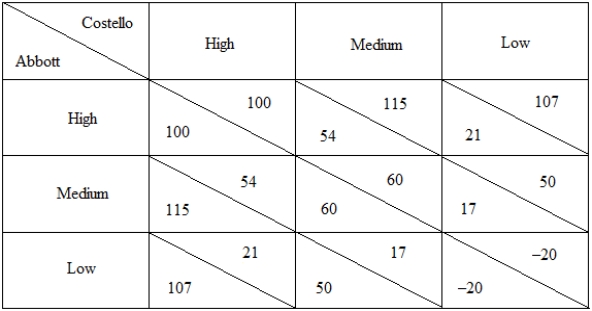

Use the following table to answer the question : Table 15-3: Abbott and Costello are two firms that compete with each other in the market for ice-cream.They can price their product at a high,medium,or low price.The following matrix shows their profits from their respective pricing strategies.

-Refer to Table 15-3.What is Abbott's dominant strategy?

Definitions:

Tax Imposed

A financial charge or levy placed by a government on an individual or an entity to fund public expenditures.

Buyer Pays

A pricing term indicating that the purchaser is responsible for the cost of goods, shipping, and any additional expenses associated with the purchase.

Tax Incidence

Describes how the burden of a tax is distributed between buyers and sellers, depending on the relative elasticities of supply and demand.

Levied On

Imposed or applied, typically in the context of taxes or duties on goods, services, or income.

Q5: Refco is company that manufactures parts of

Q6: Consider two groups of workers both facing

Q7: Which of the following correctly supports the

Q8: Refer to Figure 12-3.The price of a

Q26: Refer to Figure 10-3.The total producer surplus

Q37: Which of the following is true of

Q41: In Figure 18-2,as a result of a

Q52: Which of the following is a defining

Q57: Suppose ABC Concrete is the dominant firm

Q68: Which of the following practices allows insurance