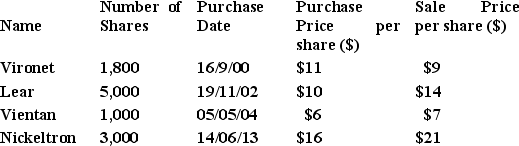

From the previous question, Belinda omitted to advise you that she also has some capital gains tax information arising from shares she had sold in the 2014 financial year. In addition, Belinda also forgot to tell you that she has a carry forward capital loss as at the start of the 2014 financial year of $3,700. All the shares listed below were sold on the 19th March 2014 with the remaining relevant capital gains tax information as follows:

a) Calculate the 2014 net taxable capital gain / loss for Belinda.

a) Calculate the 2014 net taxable capital gain / loss for Belinda.

b) Calculate Belinda's adjusted 2014 taxable income.

c) Calculate Belinda's adjusted 2014 net tax payable / refund including the medicare levy and any low income tax offset.

d) Calculate the overall change in 2014 tax liability as a result of the additional information provided by Belinda.

Definitions:

Labor Costs

The total expense incurred by employers for the compensation of their workforce, including wages, salaries, benefits, and any other forms of compensation.

Declining Customer Orders

A reduction in the number of purchases or requests for services from customers, indicating potential challenges for a business.

Dismissal

The act of terminating an employee's employment due to circumstances such as misconduct, lack of fit, or economic downsizing.

Mistreated

Subjected to bad or inappropriate treatment or behavior.

Q3: Life insurance products can:<br>A) provide for insured

Q3: Storm King Associates has a total asset

Q11: A person dying without a valid will

Q17: Examples of income tax offsets in Australia

Q19: Cash management funds would be unlikely to

Q22: To be _ _% confident that the

Q22: Briefly explain why the concept of fiduciary

Q28: Explain how securities markets provide a link

Q89: An increase in the current ratio would

Q112: Which of the following is included in