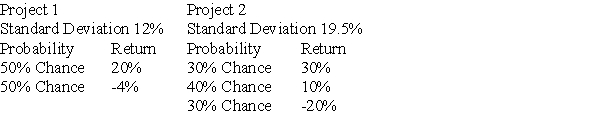

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:

Project 3

Standard Deviation 12%

If you are a risk-averse investor,which one should you choose?

Definitions:

Effective Interest Rate

This is the actual return on an investment, taking into account the effect of compounding interest as opposed to the nominal rate.

Bond Issue Costs

Expenses associated with the issuance of bonds, including legal, accounting, underwriting fees, and other costs that are often amortized over the life of the bond.

IFRS

International Financial Reporting Standards; a set of accounting standards developed by the International Accounting Standards Board (IASB) aiming for global consistency in financial reporting.

Maturity Value

The amount of money an investment will earn and pay out at the end of its life, including the initial principal and all accumulated interest.

Q4: In 2010,Sunny Electronics expects to sell 100,000

Q7: The present value of the future sum

Q8: The stockholder's expected rate of return consists

Q14: A bond has a coupon rate of

Q20: Which of the following ratios indicates how

Q33: Why do the arithmetic average return and

Q39: Project Black Swan requires an initial investment

Q56: California Investors recently advertised the following claim:

Q82: The simulation approach provides us with:<br>A)a single

Q98: When bankruptcy occurs,the claims of the common