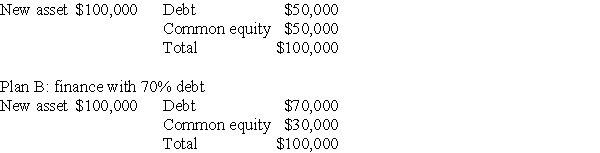

A firm is analyzing two different capital structures for financing a new asset that will cost $100,000.The effects of the two structures on the firm's balance sheet are described below.

Plan A: finance with 50% debt

Based on the information provided,we can conclude that:

Definitions:

Change

The process or act of becoming different, which can occur in various contexts such as personal life, nature, or technology.

Private Distributor Brand

Products branded by a retailer for sale in its own stores, typically positioned as lower-cost alternatives to national brands.

Q9: Which of the following is a spontaneous

Q26: Which of the following series of cash

Q30: Which of the following is NOT a

Q48: One type of real option is to

Q50: Banner's projected accounts payable balance for 2005

Q60: The ex-dividend date occurs prior to the

Q82: Lott Bros Developers evaluates a great many

Q90: In response to a temporary decline in

Q98: _ is a risk analysis technique in

Q106: Kelly owns 10,000 shares in McCormick Spices,which